Introduction:

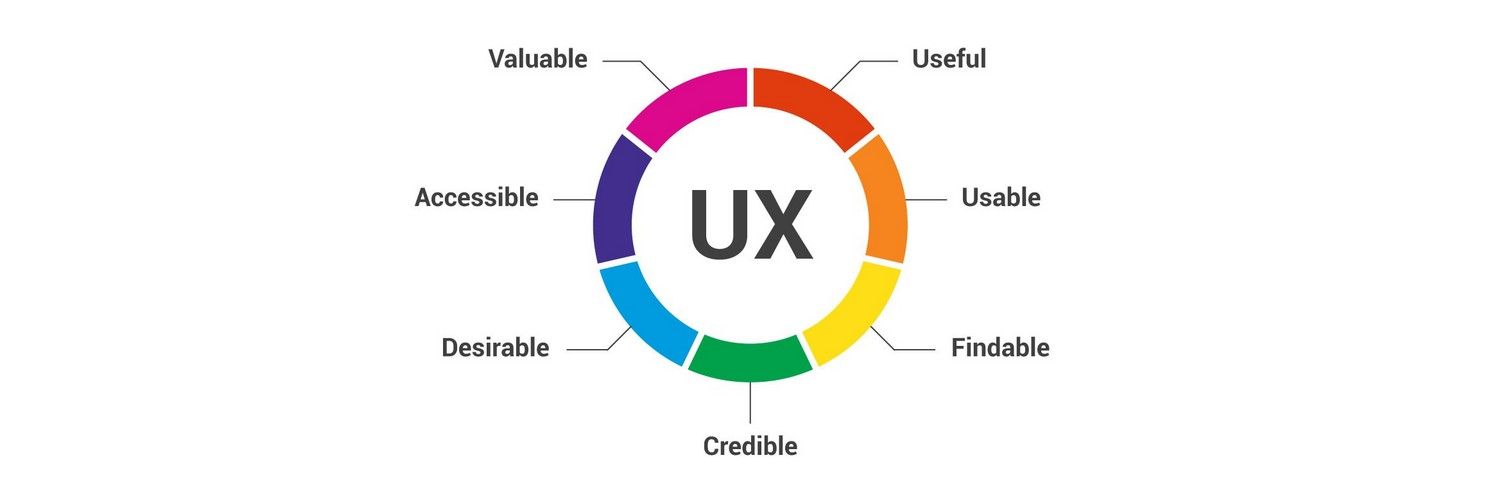

In today’s digital age, User Experience (UX) has emerged as a critical factor for the success of businesses across industries. One sector where UX plays a pivotal role is the Banking, Financial Services, and Insurance (BFSI) industry. With the rapid digitization of financial services, it has become imperative for BFSI organizations to prioritize and enhance the user experience of their customers. In this blog, we will explore the significance of UX in BFSI and how it can drive customer satisfaction, loyalty, and business growth.

Simplifying Complex Financial Processes:

The BFSI industry is known for its complex financial products and services. By leveraging UX principles, financial institutions can simplify these processes, making them more intuitive and user-friendly. An intuitive interface, clear navigation, and well-designed workflows can help customers easily understand and interact with banking applications, investment platforms, insurance portals, and other financial tools. By reducing complexity, organizations can minimize user frustration, boost engagement, and increase customer retention.

Building Trust and Confidence:

User experience plays a vital role in building trust and confidence among customers in the BFSI sector. Security concerns are paramount in financial transactions, and customers expect their personal and financial information to be safeguarded. A well-designed UX can provide visual cues and reassurances about the security measures implemented, such as encryption, two-factor authentication, and secure data transmission. By prioritizing security and instilling confidence in customers, BFSI organizations can differentiate themselves from competitors and establish long-term relationships with their user base.

Personalization and Customization:

BFSI institutions have vast amounts of customer data at their disposal. By leveraging UX principles, they can provide personalized experiences tailored to individual customer preferences and needs. Through data analysis and intelligent algorithms, organizations can offer personalized product recommendations, targeted financial advice, and customized interfaces that reflect the user’s financial goals and aspirations. Personalization not only enhances user satisfaction but also improves cross-selling and upselling opportunities.

Omni-Channel Experience:

The BFSI industry operates across multiple channels, including physical branches, online platforms, mobile applications, call centers, and more. Delivering a consistent and seamless user experience across these channels is crucial. An omni-channel approach ensures that customers can seamlessly transition between different touchpoints, such as starting an application on a website and completing it via a mobile app. By providing a unified experience, BFSI organizations can eliminate user frustration, improve customer loyalty, and maximize customer lifetime value.

Continuous Improvement and User Feedback:

UX in BFSI is not a one-time effort but an ongoing process. Collecting user feedback and actively incorporating it into the design and development process is crucial for delivering a user-centered experience. BFSI organizations can employ user testing, surveys, and feedback mechanisms to identify pain points, understand user expectations, and make iterative improvements. By involving users in the design process, organizations can build trust, foster customer loyalty, and ensure that their products and services remain relevant and valuable.

Conclusion:

In the BFSI industry, where competition is fierce and customer expectations are high, delivering an exceptional user experience is no longer optional—it is a necessity. By investing in UX, BFSI organizations can simplify complex processes, build trust and confidence, personalize offerings, provide an omni-channel experience, and continuously improve their products and services. By doing so, they can enhance customer satisfaction, loyalty, and ultimately drive business growth in the increasingly digital and customer-centric landscape of the BFSI sector.